The latest R&D figures from the ATO

Recently, our team attended a select meeting with the ATO and AusIndustry about the R&D Tax Incentive. We previously shared insights the meeting that are valuable for all businesses and accountants to know. Read more.

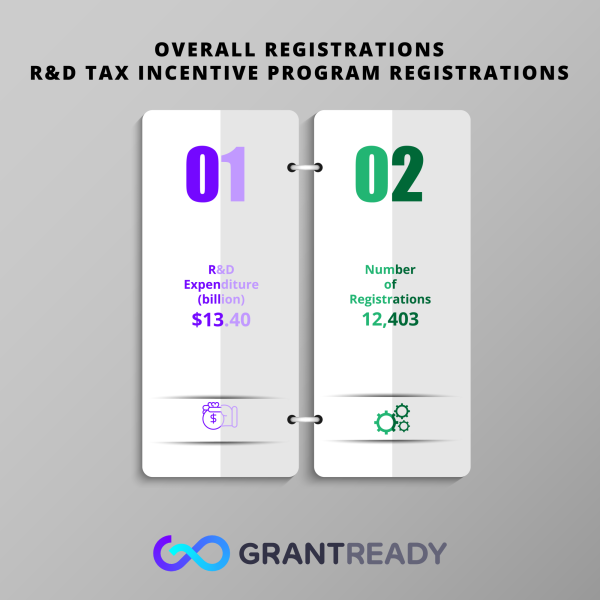

Here we reveal the $13.4 billion worth of R&D expenditure and where it went, from the latest available ATO data.

Reminder: Check your R&D eligibility and get your claim before the 2nd of May. GrantReady offer a free consultation for businesses eligible for R&D.

Over $13 billion spent as a combined total

Over 12,000 SME’s and large companies registered for the R&D tax during the 20/21 financial year and over $13 billion was spent on R&D as a combined total.

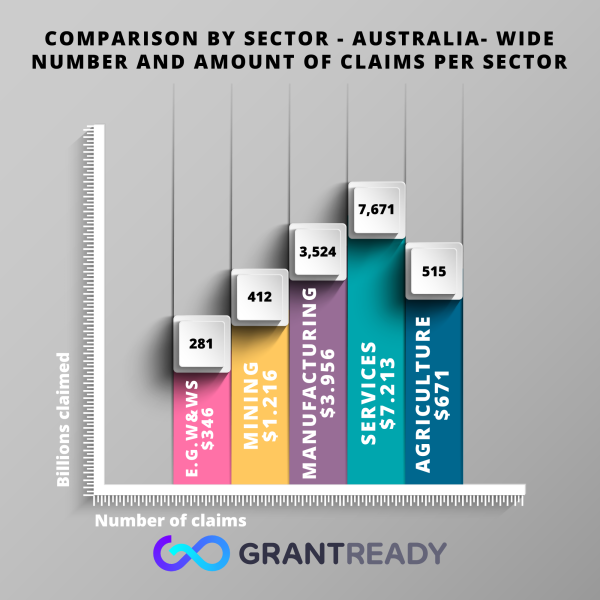

Who is claiming

Of the 12,403 businesses that claimed, 1,532 were large companies and over 10,000 were SME’s.

SME’s also claimed over half a million more in R&D tax expenditure than large companies.

The largest R&D expenditure was seen in the services sector with $7.2 billion with 7,671 claims followed by manufacturing, agriculture and mining with $1.2 billion.

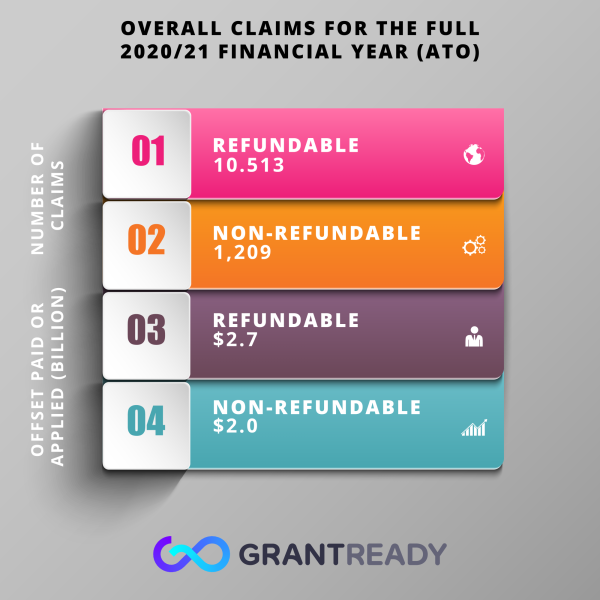

Refundable and non-refundable claims

Of the claims received 10,513 were refundable with a $2.7 billion offset and 1,209 were non-refundable with a $2 billion offset paid or applied.

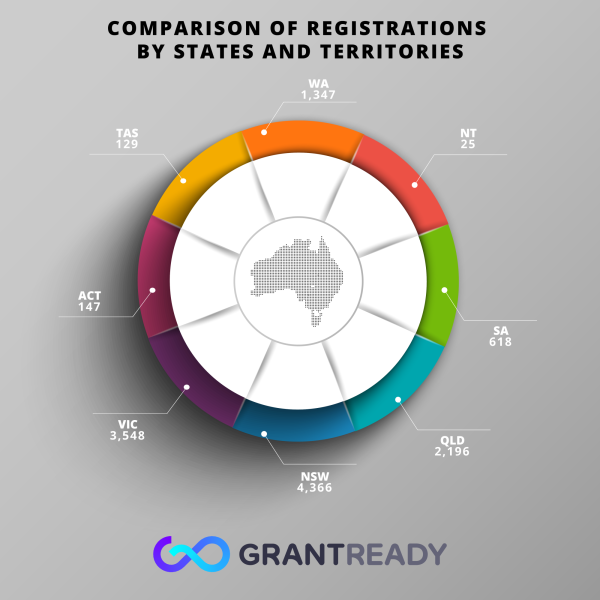

NSW’s businesses most active

Companies in NSW have been the most active in registering for R&D with over 4000 companies registering while the Norther Territory was the lowest with 25 companies registering.

Get your claim in

There is still time to get your R&D claim in.

30th April deadline change

The deadline for registering R&D tax claims, has moved from the 30th April to May 2nd in recognition of the public holidays.

If you are looking to get your application in, GrantReady is here to assist you every step of the way. Contact us to find out how we can help you get the most out of your R&D tax claims before May 2nd, 2023.

Check eligibility.

View the application process.