The R&D Tax Incentive is the single largest program in Australia to help businesses undertaking research and development activities. Over $2 billion is awarded annually and the funding is not competitive – if you are eligible, you are entitled to it.

The program is jointly administered by the ATO and AusIndustry, and registration is required for each year of income in which R&D expenditure is incurred.

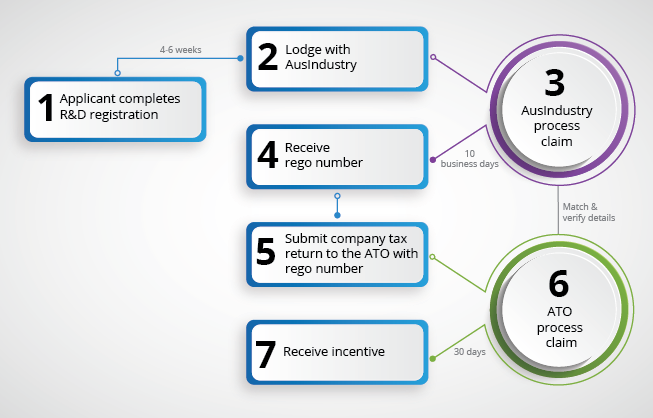

There is a 7 step process to be completed each year in order to claim an R&D Tax Incentive offset:

Companies must lodge with AusIndustry prior to submitting with the ATO. AusIndustry applications must be lodged within 10 months of the end of a company’s financial year. If you have an income year ending 30 June, activities from the 2018-19 year must be lodged with AusIndustry by 30 April 2020. Registrations after this date will not be accepted.

Companies that have already lodged their 2018-19 claims don’t need to do anything. But for those yet to start a claim don’t wait until it’s too late!

With over 20 years’ experience across multiple industries, GrantReady has a team of R&D Tax specialists that can assist. We are a registered tax agent, so we are legally allowed to submit R&D tax incentive claims.

Contact us to get R&D Tax ready: