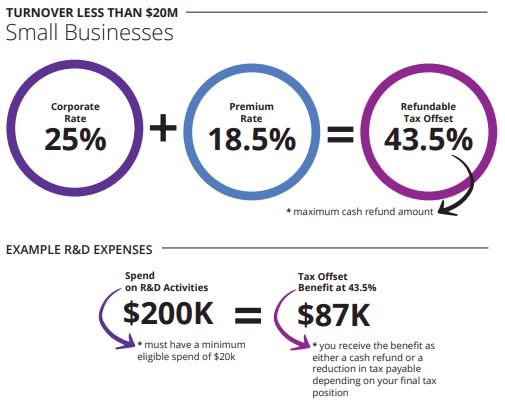

How much you can benefit depends on your company turnover and your company tax position.

Companies with a turnover <$20m

The refundable R&D tax offset for small companies is 18.5 percentage points above the claimant’s company tax rate which equates to 43.5%.

Once a company’s tax liability is reduced to zero, companies may access a cash refund for any unused offset amount.

Companies with a turnover >$20m

Larger companies face a two-tier intensity measure, based on their R&D intensity as a proportion of total expenses. R&D expenditure between 0% – 2% R&D intensity will receive a non-refundable offset of 8.5% above the company tax rate, while anything higher will receive a 16.5% non-refundable offset (above the company tax rate).

Companies cannot access a cash refund for any unused offset amount once their liability has been reduced to zero. However, these excess offsets may be carried forward into future income years.